How the technical analysis shapes the future of Dogecoin (Doge) **

The world of cryptocurrencies has experienced a meteorical increase in recent years, with many new coins of investors and dealers being attracted to popularity and attention. One Search Coin is Dogecoin (Doge), which was created by Jackson Palmer and Billy Markus in 2013. Despite Its Relately Low Market Capitalization Compared to Other Major Cryptocurrencies Like Bitcoin (Ethereum) and doogeeum, and doogeeum, and doogeeum) and doogeeum, and Doogeeum) and doogeeum, and doogeh) and dooge significant attention from the media.

In this article we will examine how the technical analysis shapes the future of Dogecoin (Doge) and give an insight into the question of why it remains a relevant and potential capital on the cryptocurrency market.

** What is technical analysis?

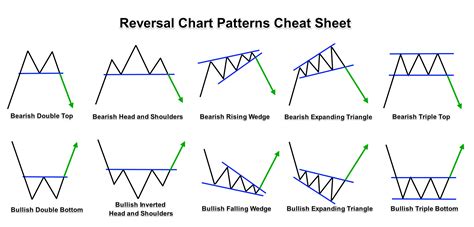

The technical analysis, also known as diagram pattern recognition or technical trade, is a method with which future price movements of assets are predicted by analyzing patterns, trends and other graphic indicators. This includes identifying and examining diagrams of historical prices in order to make well -founded investment decisions. Technical analysts use different tools such as diagram types (e.g. movable average values, trend lines), indicator symolis (e.g. RSI, Bollinger bands) and technical indicators (e.g. Fibonacci levels, support. Support.

The rise of Dogecoin (Doge)

Dogecoin was born from the internet meme “Merry Christmas” in 2013. However, it achieved considerable traction and popular around 2014-2015, when a community started to create memes and jokes over Doge. The early introduction of the coin was largely due to low market capitalization (approx. 100 million US dollars) and the relatively high trading volume.

Technical analysis in Dogecoin

In order to understand how the technical analysis shapes the future of Doge, we examine some key factors that have influenced the price movements of the coin over time:

Diagram pattern : The sliding 50-day average that is a horizontal line that combines two diagram periods (e.g. 50-day and 200 days) was used to identify short-term trends in Doge. A bullish trend line has occurred above the 50-day MA, which indicates potential buying pressure.

Trend lines : The simple, sliding average (SMA) 20 periods and 50 periods have created a long-term trend upwards, and the proposal that the price for Doge is probably constantly increasing.

Support and resistance level : The neckline, which acts as a resistance level around $ 0.25 per coin, has support for the price in the past. If the prices return below this level, this can be a sign of a potential reversal trend.

Candlestick pattern : Doges candles that issue an upward trend pattern with an upward cast pattern (i.e. the price above an earlier high), followed by a continuation of the upward trend.

Findings and predictions

Based on these technical indicators, we can make several predictions about the future of Dogecoin:

Short-term (1-3 months) : The sliding 50-day average is generated above the neckline via the neckline, which indicates that the prices may continue to rise. A bullish trend line will appear above the current price level.

In the medium term (6-12 months)

: The SMAs of 20 periods and 50 periods will probably converge up to a long-term trend and possibly reach new heights of $ 1.00 per coin.

In the long term (1-5 years) : The diagram patterns, including the upward and support level, indicate that Doge can continue to gain traction if more investors enter the market.

Diploma

Technical analysis plays an important role in the design of the future of Dogecoin (Doge). By analyzing historical price movements, trends and patterns, retailers and investors can identify potential purchase and sales signals. The diagram patterns such as uptrend lines, support levels and excerpt have given valuable insights into the market dynamics of Doge.