How to identify the cryptocurrency rising and downward trends

Cryptic currencies have been attracted in recent years, and as new exchange, wallets and investment vehicles rise, anyone is easier than ever. However, in the world of encryption currency, navigation can be overwhelming, especially when it comes to identifying rising and rough trends. In this article, we will distinguish how to detect these two key market models that can help you make conscious investment decisions.

What are rising and bears’ trends?

Before diving the specific features of the identification of rising and rough trends, we determine what they mean:

* Rising Trend : A rising trend is a long -term rise up in the price of cryptocurrency. During this time, prices usually shift higher and investors are encouraged to buy more coins. Rising trends often occur when investors believe that markets are still rising, due to growing demand and limited supply.

* Plant Trend : The growing trend is long -term in the price of the encryption currency over time. During this time, prices are usually lower and investors are encouraged to sell more coins. Plant trends often occur when investors believe that markets will continue to decline from overwhelming or decreased demand.

Identification of rising trends

So how can you identify the rising trends in the cryptocurrency? Here are some of the key indicators:

Price movement : A consistent and accelerating price movement is a good sign of the rise.

Subject increase : As the market moves up, more and more investors usually buy coins that can be considered a positive demand indicator.

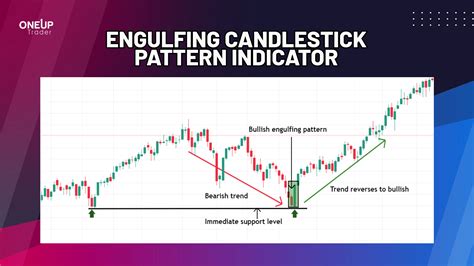

Support levels : When price breaks above the key support level, it may indicate that buyers are gaining momentum and looking for additional price increases.

Reducing market volatility : Market volatility reduction is often a sign of trust among investors, which may indicate a rising trend.

The interest of institutional investors : When institutional investors begin to invest in their cryptocurrency, it may marked increased demand and support in the market.

Identification of Plant Trends

In contrast, identifying venous trends requires a different indicator of the indicator:

Price movement : The consistent and slowed price movement is often a sign of the invoice.

Volume decreases : As the market moves down, fewer investors usually buy coins that can be considered a negative indicator of demand.

Resistance levels : When the price break is below the central resistor, it may indicate that sellers are gaining momentum and looking for an additional price decline.

Increasing market volatility : Increasing market volatility is often a sign of increased uncertainty among investors, which may indicate a declining trend.

The reduced interest of institutional investors : When institutional investors begin to sell their ownership, it may marked decreased demand and support on the market.

Tools to help you identify rising and falling trends

Use the complex data of these tools available in the cryptocurrency market:

Cryptocurrency Trade

: Websites such as CoinmarketCap, Cryptoslate and Kraken provide real-time price information and market analysis.

Mapping Software : Tools such as TradingView and Thinktorswim give you to create customized charts and analyze market models.

Technical indicators : indicators such as moving averages, relative strength index (RSI) and bollinger lanes can be used to identify trends.

conclusion

Identifying the rising and declining trends of cryptocurrency requires a combination of technical analysis, market research and critical thinking.